The Climatology of Weather-Related Insurance Claims

Florida has a property insurance problem: the state accounts for 6.5% of the population, 9% of all homeowners’ property insurance claims, and 79% of all lawsuits filed over such claims in the U.S.

Florida is a clear outlier among U.S. states in the proportion of insurance claims that are litigated, and the financial burden of that litigation has become a severe strain on the Florida property insurance marketplace. Average homeowners’ insurance premiums have more than doubled over the past 3 years; several insurers have been declared insolvent; many more have stopped writing policies in Florida or are no longer insuring homes with older roofs; and the financial stability rating of nearly two dozen Florida insurers has been threatened with downgrade.

Research from the Florida Office of Insurance Regulation (OIR) indicates that Florida insurers are not disproportionately denying claims, but rather that a disproportionate number of denied claims are being litigated. The OIR has identified a number of legislative factors that incentivize expensive claims-related litigation, including one-way attorney fees and third-party assignment of benefits (AOBs), which the signing of SB 2A in December 2022 recently eliminated.

Many of the litigated claims in Florida are weather-related – often for roof damage due to wind and hail. However, little has been done to investigate how the occurrence of severe weather itself impacts the number and cost of such weather-related claims. In other words, do we see more and costlier weather-related claims in areas impacted by more and worse severe weather?

To answer this question, Blue Skies’ principal atmospheric scientist – Megan D. Walker, CCM – analyzed 15 years of weather and insurance claims data in Florida and seven other southeastern states. She presented the results of this research at the 103rd Annual Meeting of the American Meteorological Society (AMS) in Denver, CO in January.

The extended abstract is available from the AMS website or by clicking the icon below for a full-resolution copy, and we’ll update this post with the video link once it’s released to the public. The analysis revealed interesting results, including:

- In all states, there are moderate to strong seasonal correlations between the number of hail-related insurance claims and the number of official storm reports of severe hail. A similar relationship exists between wind-related insurance claims and reports of severe wind.

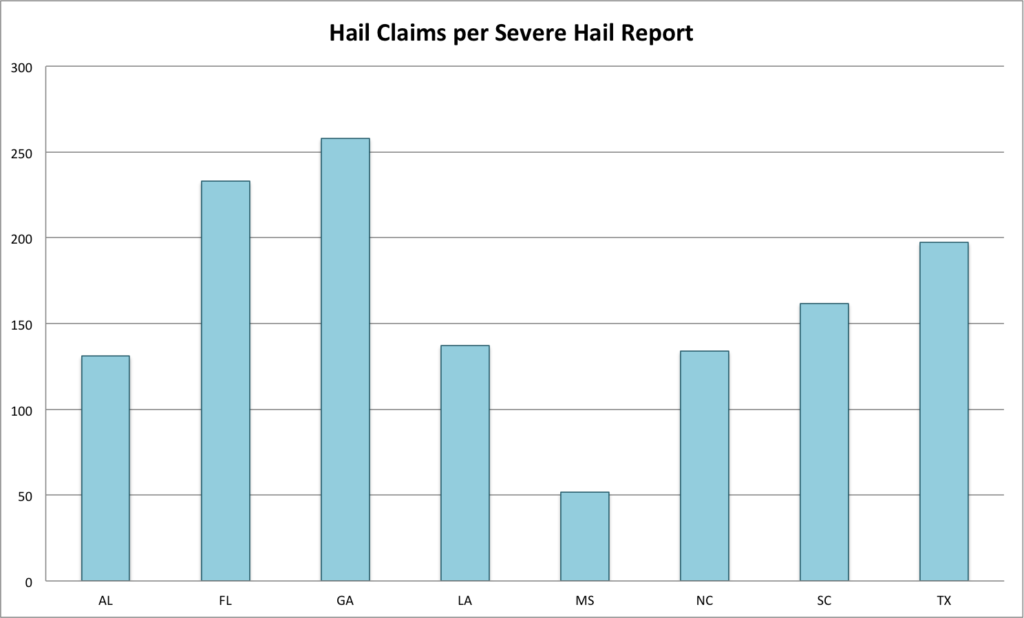

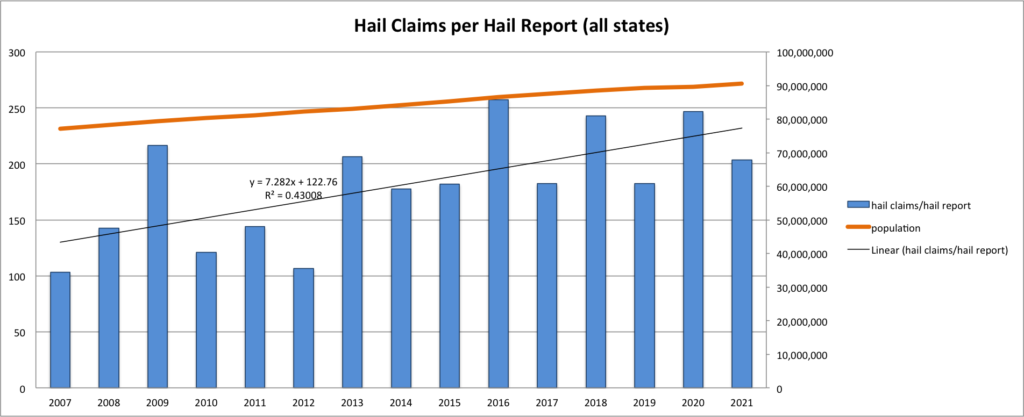

- All eight states show a trend toward an increasing number of hail claims per hail report (i.e. the number of claims for hail-related damage that are filed for every official National Weather Service report of severe hail). This trend outpaces population growth in all states but one.

- Claims are not substantially more likely to be denied in states with more hail claims per hail report

- Average claim costs are not higher in states with more large hail reports per square mile

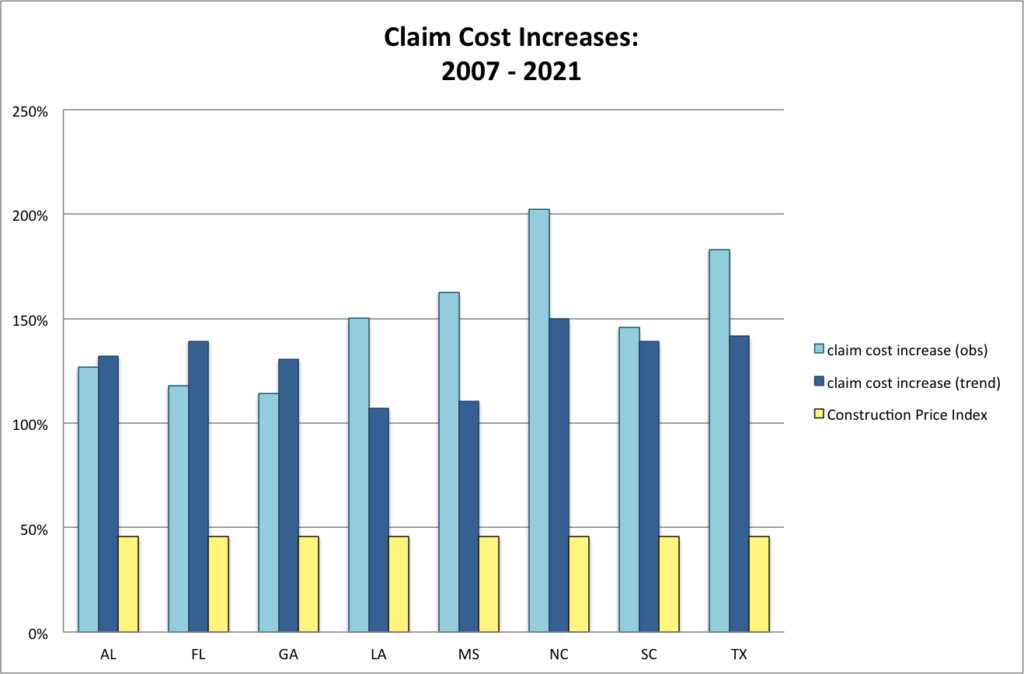

- Average claim costs have more than doubled in all states during the study period, far outpacing inflation

For more information about this research, please read the extended abstract, and feel free to contact Blue Skies with any related questions you may have. We’re excited to share the results of this work with the insurance and meteorological communities!